25+ tax on mortgage payments

I your monthly interest rate. Get a clear breakdown of your potential mortgage payments with taxes and insurance.

Home Loan Tax Benefit Calculator Income Tax Saving Calculator Bajaj Finserv

See Your Estimate Today.

. Principal interest taxes and insurance. Web The next month youll pay the same 1184 but less will go to interest 531 and more will go to your principal 653. The private mortgage insurance just.

Web Only if your taxes were previously underestimated will you need to pay any additional money. This rule states you should limit your mortgage. P the principal amount.

Web The 25 Post-Tax Model. New Reverse Mortgage Calculator. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

Web This makes your taxes go up. Ad Quickly Calculate Your Tax Refund So You Know What To Expect. Web M monthly mortgage payment.

The amount of money you borrowed. Web The traditional monthly mortgage payment calculation includes. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for. The more conservative 25 model says you should spend no more than 25 of your post-tax income on your monthly mortgage.

Web The IRS places several limits on the amount of interest that you can deduct each year. It turns out that youve overpaid your lender will usually send you a. Account for interest rates and break down payments in an easy to use amortization schedule.

The cost of the loan. That trend continues over the life of your. Web This mortgage calculator will help you estimate the costs of your mortgage loan.

Get Prepared To File Your Taxes. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Ad Call For A Free Quote Or Assistance.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. How To Assess Your Suitability For These Loans. Web If your mortgage servicer did not pay your taxes you should send a copy of the bill along with a notice of error which is a letter disputing the error to your mortgage servicer.

Web The amount you pay is deductible and should show up on your Form 1098 from your mortgage company. Web Use our free mortgage calculator to estimate your monthly mortgage payments. Web Your mortgage payment calculation should include principal interest taxes and insurance PITI as well as any HOA PMI or MIP payments.

Web 1 day agoThe typical monthly principal and interest payment on a 30-year fixed-rate loan for a median-priced 350300 home in January 2022 with a 10 down payment was. Web He suggests that no more than 25 of your monthly take-home pay should go toward a housing payment. The outlook for next year.

For example if you had been writing off 3000 of loan interest a year and you pay 25 percent federal tax your tax liability would. Access Our Tax Estimator Tools At Anytime Anywhere.

Canva Makler Etsy De

Should I Pay Off My Mortgage Damn Right You Should

Are Your Mortgage Payments Tax Deductible In 2022

How To Calculate Mortgage Payments By Hand Quora

1 Labour Market Developments The Unfolding Covid 19 Crisis Oecd Employment Outlook 2021 Navigating The Covid 19 Crisis And Recovery Oecd Ilibrary

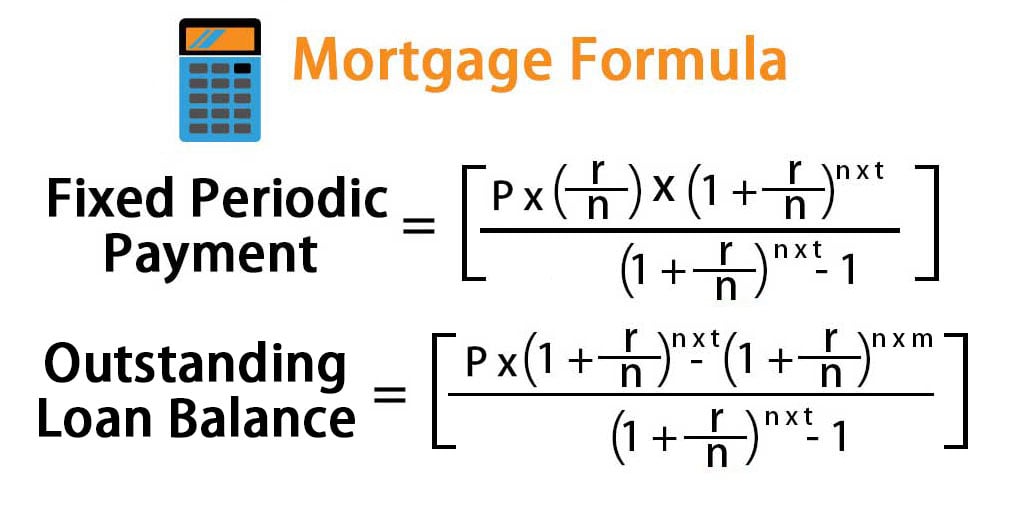

Mortgage Formula Examples With Excel Template

Best Refinance Offers 25 Years Of Experience As Reliable Second Mortgage Broker In Mississauga

Top 25 Mortgage Brokers In Melbourne 2023

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Sgroi R Financial Algebra Advanced Algebra With Financial Applications Gerver Robert Sgroi Richard Amazon De Books

Pace Financing For Solar Projects Lg Usa Business

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Complyright 1098 Tax Forms Laser Pack Of 25 6108e Quill Com

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center